ArcBest booked another large tonnage decline in its asset-based unit during the first quarter as it purges transactional freight from its network in favor of a mix more weighted to shipments from core customers. The swap is generating big improvements in yields, but revenue continues to sag. It expects the large year-over-year (y/y) swings to calm by the third quarter.

The company leaned on a dynamic pricing model during the downturn, pricing certain lanes at lower rates to keep the network filled with freight. That allowed ArcBest to prop up equipment and labor utilization as demand fell across the industry.

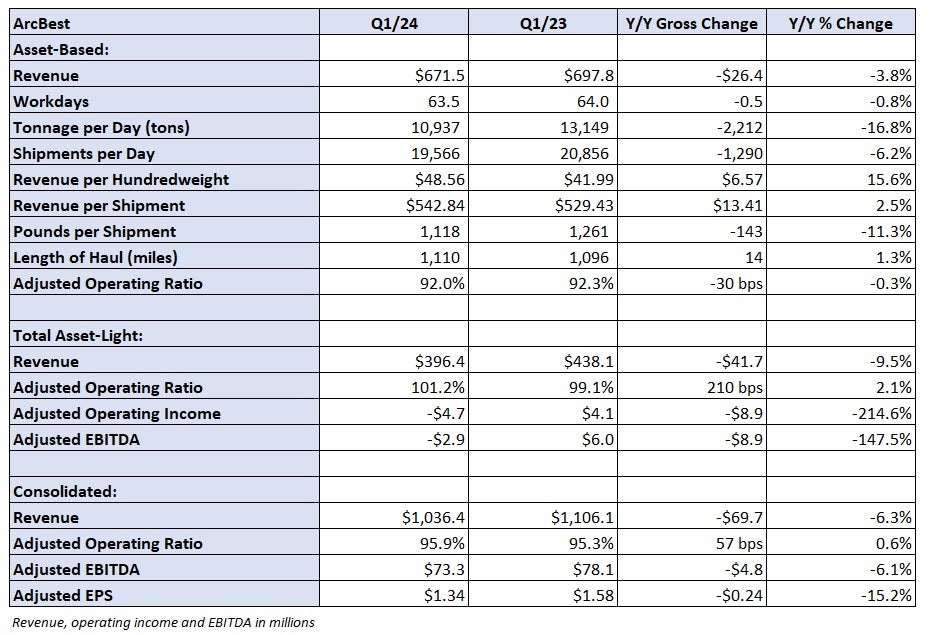

ArcBest’s (NASDAQ: ARCB) asset-based segment, which includes less-than-truckload operations, reported revenue of $672 million, a 4% y/y decline. Tonnage per day was down 17% while revenue per hundredweight, or yield, increased 16%. The tonnage decline was the combination of a 6% decline in daily shipments and an 11% decline in weight per shipment.

Daily tonnage was down 6% from the fourth quarter while yield was off 1%.

The declines accelerated into April, with tonnage falling 22% y/y and 21% on a two-year-stacked comparison. Declines in both the y/y and two-year comps have accelerated from a February low. January (down 18% y/y) was impacted by severe winter storms. February was off 13.9% and March was down 17.9%.

Management said freight demand from core accounts was in line with normal seasonal trends from the fourth to first quarter. In the first quarter, core shipments increased 12% y/y and tonnage was up 9%. So far in April, core shipments are up 13% y/y and tonnage is 9% higher.

The y/y declines should moderate in the third quarter as the company laps the tough comps. It reversed course on its dynamic pricing initiative near the end of the 2023 second quarter when it became clear Yellow Corp. (OTC: YELLQ) would likely fail. Yellow’s customers started seeking other capacity options weeks ahead of its eventual shutdown, allowing ArcBest and the rest of the industry to onboard more share from contractual customers.

ArcBest said catalysts for tonnage increases include a return of freight that left the industry for cheap truckload pricing, a pickup in the industrial economy and more share from primary accounts.

The improved freight mix boosted yield metrics in the first quarter, although the drop in weight per shipment was a tailwind. Pricing on contract renewals and deferred agreements was up 5.3% y/y in the quarter, following a 5.6% increase in the fourth quarter.

The asset-based segment recorded a 92% adjusted operating ratio, 30 basis points better y/y but 430 bps worse than the fourth quarter. Salaries, wages and benefits as a percentage of revenue increased 330 bps y/y, mostly due to the new labor contract with its union workforce.

The segment normally sees 200 to 300 bps of OR improvement from the first to second quarter. Management didn’t provide a definitive guide for the second quarter this year.

The unit appears to have some favorable operating leverage in the back half of the year as core rate increases likely outpace labor inflation. Its five-year labor contract with the Teamsters union became effective July 1 last year with more than half of the total wage increase being implemented in the first year.

ArcBest missed first-quarter expectations ahead of the market open on Tuesday, reporting a net loss of $2.9 million, or 12 cents per share. Excluding items the company considers nonrecurring (various costs from technology pilots and acquisition-related expenses), it reported adjusted earnings per share of $1.34, 19 cents light of consensus and 24 cents lower y/y.

The adjusted result excluded a $21.6 million write-off of its equity investment in Phantom Auto, which shut down during the period. Phantom Auto developed technology allowing remote control of forklifts and yard trucks. ArcBest said the void has been filled with another technology it has created — Vaux Smart Autonomy.

The company’s asset-light unit, which includes truck brokerage, weighed down results.

The unit reported a $15.3 million operating loss, a $4.7 million loss on an adjusted basis. Revenue was off 10% y/y to $396 million. Managed transportation shipments per day increased 14%, but revenue per shipment was down 20%.

Poor weather in January, which sent TL spot rates (purchased transportation expenses) higher, was cited as the culprit. Purchased transportation costs as a percentage of revenue have continued to step lower since January. Management believes efficiency and productivity initiatives will allow more revenue (including rate increases) to fall to the bottom line when the market corrects.

The company reiterated net capital expenditures of $325 million to $375 million for 2024. The capex budget includes $155 million in equipment purchases and $130 million for real estate projects. ArcBest will also invest in technology and upgrade dock equipment.

Shares of ARCB were off 14.6% at 11:36 a.m. EDT on Tuesday compared to the S&P 500, which was off 0.7%. Shares of other LTL carriers were flat to down 3% at the time, continuing a notable sell-off since Old Dominion Freight Line (NASDAQ: ODFL) reported results on Wednesday. Most LTL stocks are down midteen percentages to mid-20% over the past week.

DB416

The mobile platform and robots aren’t the answer to profitability with the type of freight ABF is focused on. Over length, non-symetrical, easily damaged, easily lost shipments may look like a great idea to someone that’s never handled that type of freight at a computer screen. The mobile platform takes away 5000lbs of a trailers’ tonnage right off the top. No way that R2D2 and CPEO can figure out how to load and unload that type of freight and make that trailer profitable. The shipments that theyre focused upon moving now is human hands on (labor intensive) and a massive challenge to handle claims-free. Moving that freight from origin to destnation terminals is one challenge, transferring it to the P&D trailer for final delivery is another. They’re heavily invested in that new technology and still throwing money down that pit. They’re digging their own grave and it’s only a matter of time .

Freight Zippy

Ha PNW compares ABF to Yellow..

There may be a freight recession, it’s mostly in Full Truckload.

When Teamster Carriers Yellow (New Penn, Holland & Reddaway) failed last summer it was a once in a lifetime event for ABF. 50,000 daily shipments were up for grabs…..

Saia in this same freight ‘recession managed to operate at 84, ODFL even better….

Somehow other carriers managed to grow and operate better but once again the Teamster Carriers cannot compete with their nimble nonunion competitors.

Too bad for ABF because if Dwight Eisenhower was still President all would be great…

Rich w s

You can blame anything you want the bottom line is the economy. Everything you own was on at least one truck. When trucks are not moving freight it’s the economy.

PNW

Typical Freight Zippy comment. Funny how you never comment on the non union companies that fail. You should probably actually look at a current freight contract and maybe you would see the difference from the “1950’s”. Sure looks to me like all the carriers are struggling with the current market. Yes some are still making money, but many are not. For a union carrier to post 92 OR in this freight environment is not bad at all. I doubt Yellow had a OR that good in the last several years. Mangement has always played a role in the failures of the big companies….study the history of what really happened to the companies that failed. Many made some poor business decisions. To just blame the fact that they were union is a lame, short sighted excuse. Grow up!!!

DB416

ABF is a company that hires upper management that had no experience handling freight or driving trucks. How can you expect someone to make wise decisions (sales, routing, setting appointments, etc…) when they have no clue how to do the job themselves ? Add to it the fact that they fill positions with people from outside of the local service area. These new hires have no experience with local road restrictions, traffic patterns, customer needs, etc.. We’re never asked for input about freight and customer specifics. When we have offered advice for present and future reference, in one ear and out the other. They know best (so they think). Efficiency is NOT in the ABF vocabulary.

Freight Zippy

Looks like ABF is going to be the next Teamster Carrier to fall victim to the 1950’s work rules?

They are circling the drain….

Of course the union will do nothing to save them… Just watch them fail andthrow blame at others…